Yes, You Gotta Pay Taxes on Winnings

Mar 17 | 2025

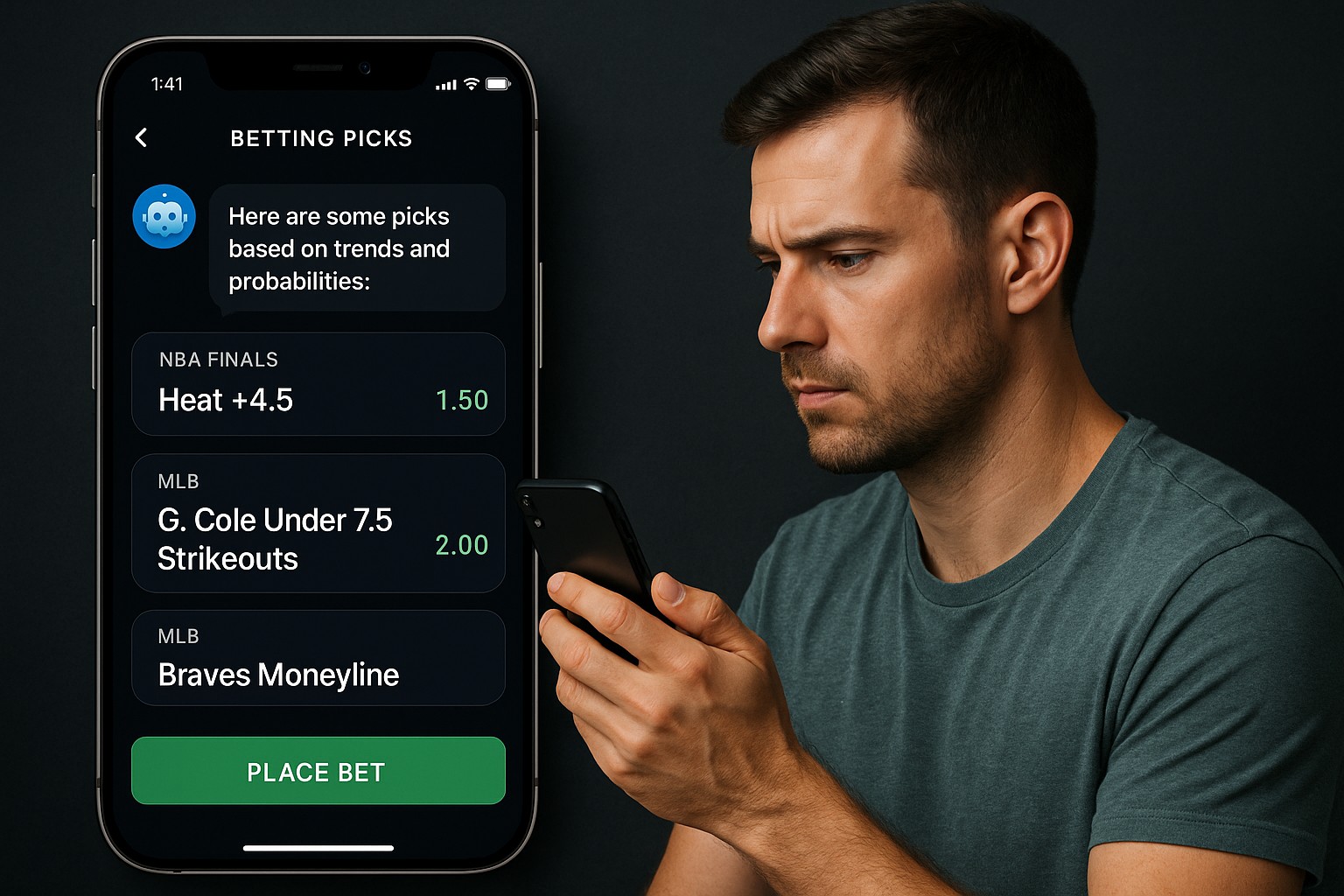

Image by Vu Huy Hoang Chu for Unsplash

Do You Really Have to Pay Taxes on Sports Betting Winnings?

Short answer: Yes. Long answer: Yes – and here’s why.

The IRS considers gambling winnings taxable income. That means you’re required to report everything from your Super Bowl squares to that last-minute NBA prop bet.

Even if you’re betting with an online sportsbook or a casino app, your winnings don’t go unnoticed. If you’ve ever won more than $600 from a sportsbook, you’ve probably received a W-2G form. This is the IRS’s way of saying, “Good for you – and now we’d like our cut, please.” But even if you don’t get a W-2G, you’re still legally required to report your winnings.

How Are Sports Betting Winnings Taxed?

Sports betting winnings are taxed as ordinary income at the federal level. The rate depends on your tax bracket. Here’s a rough idea of what that looks like for 2024:

● 10%: Up to $11,600 (single filers)

● 12%: $11,601 – $47,150

● 22%: $47,151 – $100,525

● 24%: $100,526 – $191,950

● And so on…

On top of that, some states tax gambling winnings as well, and the rate varies depending on where you live (looking at you, New York and California).

And remember If you won big—really big—the IRS might take 24% right off the top. Even so, you’re not off the hook when tax season rolls around. If you end up owing more based on your total income, you’ll have to pay the difference.

But Wait… What About Gambling Losses?

Good news! You can deduct your gambling losses—but only if you itemize deductions. And you can only deduct up to the amount of your reported winnings.

For example, if you won $5,000 but lost $3,000, you can only deduct $3,000. If you lost more than you won (sorry to hear that!), you can’t deduct the excess.

To make these deductions, you’ll need to keep records of:

● Your bets (date, amount, sportsbook, type of bet)

● Winnings and losses

● Bank statements or sportsbook transaction history

Document your betting history the way you’d keep track of business expenses. Because, in the eyes of the IRS, that’s essentially what they are.

How to Report Your Winnings

So, where does all this go on your tax return?

● Form 1040: Your gambling winnings get reported under “Other Income.”

● Schedule A: If you’re deducting losses, this is where they go.

● W-2G (if applicable): If your sportsbook sent you this form, don’t ignore it—make sure those winnings are accounted for.

And if you’re a full-time sports bettor, you might be classified as a professional gambler. That means you’d file your winnings and losses as business income on Schedule C, and you may even owe self-employment tax.

What Happens If You Don’t Report Winnings?

Some folks try to ignore this whole process and hope the IRS won’t notice, but not reporting your gambling winnings is a gamble you don’t want to take – much less lose.

The IRS receives copies of those W-2G forms from sportsbooks. If you don’t report your winnings and they see a mismatch, you could get hit with penalties, interest, or even an audit. No one wants to spend tax season explaining every DraftKings transaction to a guy in a suit. Don’t risk being the guy who has to talk with the guy in a suit.

Smart Moves for Tax Season

To make your life easier when it’s time render unto Caesar what is Caesar’s, a few pro tips:

✅ Track your bets year-round – Keep a simple spreadsheet or use sportsbook account statements. ✅ Set aside a percentage of winnings – Treat it like a paycheck with automatic tax withholding. ✅ Use a tax professional – If you’re betting regularly, an accountant can help you maximize deductions and stay compliant. ✅ Don’t ignore state taxes – Some states require separate filings for gambling income.

The Wrap Up

Winning big on sports bets is a rush, but don’t let taxes harsh your buzz. If you’re smart about tracking your bets, setting money aside, and filing properly, you won’t have to worry about the IRS knocking on your door.

So go ahead: place those bets, cash those tickets and, when tax season comes, handle your business like a pro. (Or at least like someone who doesn’t want an audit.)